Alabama’s 2025 Legislative Session Advances Pro-Growth Tax Reforms

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

5 min read

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

5 min read

With reports that Republican legislative leaders and Wisconsin Gov. Evers (D) have reached a budget deal for FY 2026 and 2027, it is worth examining two significant tax relief proposals included in the plan.

7 min read

Tax Foundation Europe’s Sean Bray interviews Dr. Monika Köppl-Turyna, director of the EcoAustria Institute for Economic Research, about the future of the EU tax mix.

14 min read

Lawmakers are right to be concerned about deficits and economic growth. The best path to address those concerns is to ensure OBBB provides permanent full expensing of capital investment, avoids inefficient tax cuts, and offsets remaining revenue losses by closing tax loopholes and reducing spending.

8 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

New Jersey’s residents deserve tax relief, and the state must stem the tide of out-migration. Affordable reforms in the near term could pave the way for more sweeping, and competitive, reforms to take root in the future.

Tax Foundation Europe’s Sean Bray had the opportunity to interview Dr. Stefanie Geringer, a postdoctoral researcher at the Faculty of Law at the University of Vienna and Masaryk University Brno, a certified tax advisor and manager of tax at BDO Austria, about the future of the EU tax mix.

14 min read

If Illinois’ budget is enacted as-is, Illinois will newly tax 50 percent of Global Intangible Low-Taxed Income (GILTI) as of tax year 2025, retroactively increasing tax burdens for US businesses and further hindering Illinois’ business tax competitiveness.

7 min read

President’s Trump’s policies would throw high-tax states a life raft as they swim against the tide—before potentially hitting all states with a tariff-induced economic tsunami that could force lawmakers’ hands and reverse recent tax relief.

Rhode Island lawmakers are debating raising the state’s top income tax rate. Though billed as a tax hike on high earners, the consequences would manifest across the state’s entire economy—creating a risk that Rhode Island will tax its way into uncompetitiveness.

The House-passed “One Big Beautiful Bill” includes a new 3.5 percent tax on remittances, or non-commercial transfers of money that people in the US send to people abroad.

7 min read

The House tax and spending bill leaves in place a long-standing provision that exempts credit unions from federal and state income tax, allowing them to compete unfairly with banks and, increasingly, to buy them.

6 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Florida’s latest property tax debate highlights the familiar challenge of prioritizing pro-growth tax policy while tackling rising property tax burdens.

6 min read

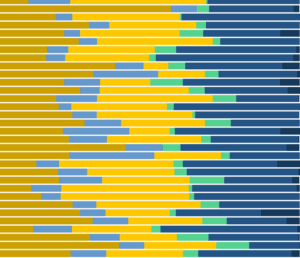

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

The House of Representatives just passed President Trump’s “One Big Beautiful Bill,” marking a critical step in the Republican tax agenda. At first glance, the bill might appear to complete the legacy of the 2017 Tax Cuts and Jobs Act (TCJA). But it falls short of emulating the TCJA’s core strengths in two key respects: it doesn’t prioritize economic growth, and it doesn’t simplify the tax code.

With such important changes to Montana’s property tax system at stake, it’s important that lawmakers get the details right.

5 min read

As lawmakers consider options for budgetary offsets, they should prioritize competitiveness and economic growth, as a heavier corporate tax burden will undermine the core purpose and achievement of the TCJA.

24 min read

Lawmakers have a prime opportunity to achieve a more stable economy through the debate about the tax code that is now ramping up.

As lawmakers continue to debate the “One Big Beautiful Bill,” they should abandon temporary and complex policy in favor of simplicity and stability.

4 min read