Alabama’s 2025 Legislative Session Advances Pro-Growth Tax Reforms

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

5 min read

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

5 min read

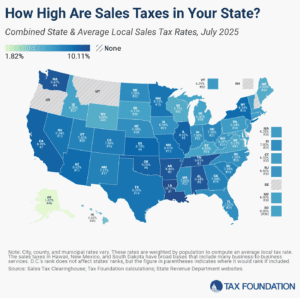

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

17 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

If Michiganders are interested in increasing the state’s spending on education or other priorities—and believe that current revenues are insufficient to support such an increase—there are several ways to do so without significantly affecting residents’ incentives to live and work in Michigan.

4 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

Florida’s latest property tax debate highlights the familiar challenge of prioritizing pro-growth tax policy while tackling rising property tax burdens.

6 min read

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

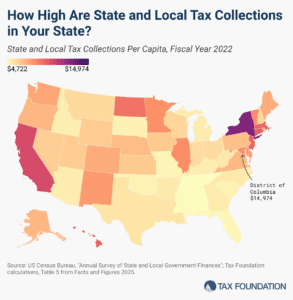

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

Policymakers may consider a broader, more comprehensive property tax reform that creates a uniform system with effective levy limits to prevent unauthorized increases in property tax revenues and, in most cases, property tax bills.

4 min read

Montana’s 2025 legislative session has seen a flurry of property tax reform proposals, a response to the surge in property valuations in the state. Unfortunately, hasty decision-making can result in suboptimal policy outcomes.

6 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

While Governor Moore’s tax plan is still being fiercely debated in Maryland, legislators have introduced several additional proposals—mostly aimed at increasing taxes on businesses—to generate revenue and address the state’s chronic budget deficit.

6 min read

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

55 min read

The Trump administration appears to be moving in a “reciprocal” policy direction despite the significant negative economic consequences for American consumers of across-the-board tariffs on goods coming into the US. However, the EU’s VAT system should not be used as a justification for retaliatory tariffs.

6 min read

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

While tariffs are often presented as tools to enhance US competitiveness, a long history of evidence and recent experience shows they lead to increased costs for consumers and unprotected producers and harmful retaliation, which outweighs the benefits afforded to protected industries.

Lawmakers will enter the 2025 fiscal legislative session with an opportunity to build on the successes of the November special session. Efforts should include addressing the outstanding issues within the corporate and sales tax codes that currently hold the state back.

7 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read