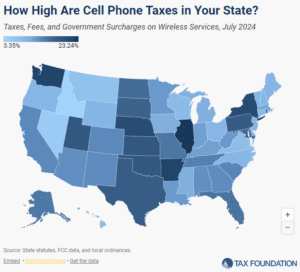

Excise Taxes and Fees on Wireless Services Increased 8.8 Percent in 2024

Wireless taxes and fees set a new record high in 2024.

23 min read

Wireless taxes and fees set a new record high in 2024.

23 min read

As part of the 2024 presidential campaign, Vice President Kamala Harris is proposing to tax long-term capital gains at a top rate of 33 percent for high earners, taking the top federal rate to highs not seen since the 1970s.

3 min read

Bob Stack, an international tax expert, explores the implications of the EU’s adoption of Pillar Two and the potential for streamlining overlapping policies. He also addresses the issues that the US faces in global tax policy with the upcoming elections.

The gap between statutory rates and average effective tax rates for personal income tax in the European Union varies significantly, affecting the efficiency and simplicity of the tax system.

32 min read

Legal sports betting has grown rapidly since the Supreme Court granted states the ability to establish online sports betting markets in Murphy vs. NCAA in 2018.

3 min read

Oregon’s Measure 118, though presented as a tax on big business, would function as an aggressive sales tax on consumers.

7 min read

Nationwide, property owners have experienced surges in valuations and are demanding tax relief. Lawmakers are right to find ways to provide it, but should do so with sound tax principles in mind.

5 min read

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

Taxes are on the ballot this November—not just in the sense that candidates at all levels are offering their visions for tax policy, but also in the literal sense that voters in some states will get to decide important questions about how their states raise revenue.

9 min read

While tax policy was almost nonexistent in the first debate between Vice President Kamala Harris and former President Donald Trump, this episode will explore each candidate’s latest proposals in greater depth.

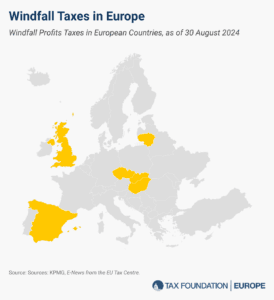

Supernormal profits are an important concept, but we should be wary of analysis that both defines supernormal profits very broadly and equates all supernormal profits with monopoly profits that can be easily taxed without negative economic effects.

23 min read

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read

Rather than pursuing temporary policies, policymakers should implement long-term, pro-growth tax reforms that stimulate economic activity and incentivize energy diversification by supporting private investment through full expensing.

19 min read

Allowing full deductibility of residential structures would mean more housing construction, particularly multifamily housing—a practical solution to address housing affordability challenges.

6 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

22 min read

Eliminating the property tax will unfortunately set North Dakota back in significant ways, making the state a national outlier and eroding regional competitiveness.

6 min read

World War II shaped many aspects of the modern world, including the US tax code. But the dramatic changes to our system that military mobilization required didn’t subside when the fighting finished; they’ve persisted to today.

4 min read

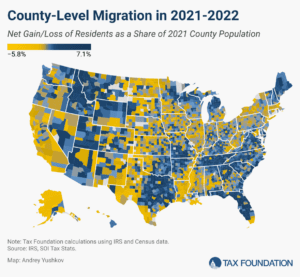

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

If lawmakers are convinced that new revenues must be part of any long-term effort to solve the budget crisis or offset the cost of extending the TCJA, they must choose the least harmful ways of raising new revenues or else risk undermining their efforts by slowing economic growth.

7 min read