Featured Articles

All Related Articles

New OECD Study: Consumption Tax Revenues during Economic Downturns

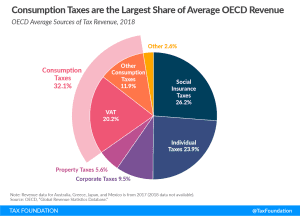

Compared to other tax revenue sources, consumption tax revenue as a share of GDP tends to be relatively stable over time, even during economic downturns.

2 min read

VAT Bases in Europe

The extent to which businesses and consumers will benefit from coronavirus relief measures like temporary VAT changes will depend on the VAT base.

2 min read

Denmark Unplugs the Economy

Denmark, a high-tax country with 5.5 million citizens, has implemented policies designed to avoid layoffs and bankruptcies and basically unplug the economy during the pandemic.

4 min read

Norway Opens the Fiscal Toolbox

Norway passed a large coronavirus tax relief package to address layoffs and bankruptcies, which includes a reduced VAT rate, the introduction of a loss carryback provision, and targeted postponements for wealth tax payments, among other provisions.

5 min read

Tax Policy and Economic Downturns

The Great Recession provides some insight into how tax revenues declined during a deep recession. Across OECD countries, revenues fell by 11 percent from 2008 to 2009 with corporate income taxes seeing the steepest decline at 28 percent. Revenues from individual income taxes fell by 16 percent.

4 min read

Reliance on Consumption Taxes in Europe

2 min read

FAQ on Digital Services Taxes and the OECD’s BEPS Project

What is a digital services tax (DST)? What countries have announced, proposed, or implemented a DST? What are some of the criticisms of a DST? What are alternatives to a DST? What is the OECD BEPS project and what is its main objective? What is the main objective of OECD Pillar 1? What is the main objective of OECD Pillar 2?

8 min read

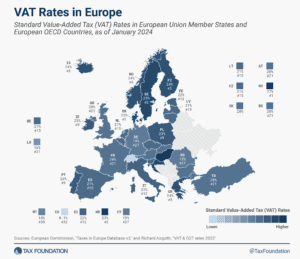

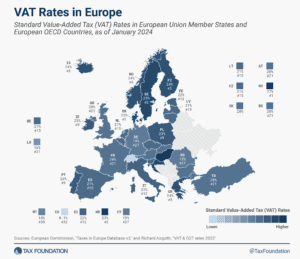

VAT Rates in Europe, 2020

4 min read

Welcome to the Index, Lithuania!

5 min read

UK Taxes: Potential for Growth

3 min read

International Tax Competitiveness Index 2019

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

11 min read

No Good Options as Chicago Seeks Revenue

Facing an $838 million budget shortfall, a looming pension crisis, and an aggressive spending wish list, some Chicago policymakers and activists are expressing interest in a laundry list of new and higher taxes that could, collectively, raise as much as an additional $4.5 billion a year.

6 min read