Alabama’s 2025 Legislative Session Advances Pro-Growth Tax Reforms

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

5 min read

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

5 min read

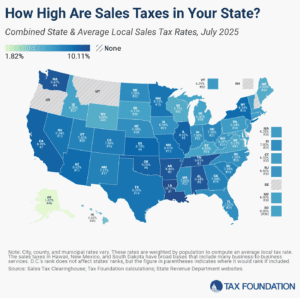

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 24 percent of combined state and local tax collections.

17 min read

This legislative session, local taxes are a major topic of debate in Indiana. Although the state’s property tax system is already nationally competitive, dramatic increases in assessed values have created discontent in recent years.

8 min read

With property tax bills on the rise, homeowners are searching for answers—and some even want to abolish the tax altogether. In this episode, we break down why property taxes are increasing, common but flawed solutions, and why the property tax remains an economically efficient revenue source.

As Kansas policymakers consider ways to provide long-term property tax relief, a well-structured, exemption-free levy limit would be a structurally sound and effective reform to consider.

8 min read

Nebraska has an opportunity to revise the property tax package enacted in 2024 to ensure that Nebraskans enjoy meaningful property tax relief.

32 min read

The long-term value of these projects to the broader public remains highly debatable.

Sports stadium subsidies are salient political gimmicks designed to appear as if politicians are providing tangible benefits to taxpayers. The empirical evidence shows repeatedly that stadium subsidies fail to generate new tax revenue and new jobs or attract new businesses.

6 min read

States would do better to broaden the sales tax base to include currently exempt classes of final consumption than to impose disproportionate taxes on prepared foods.

6 min read

To stay competitive in an increasingly mobile post-pandemic world, states and localities must learn from the tax policy successes and failures of their neighbors and communities across the nation.

27 min read

Gross receipts taxes impose costs on consumers, workers, and shareholders alike. Shifting from these economically damaging taxes can thus be a part of states’ plans for improving their tax codes in an increasingly competitive tax landscape.

7 min read

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read

Nebraskans need property tax relief and there are sound ways to provide it. However, increasing the sales tax rate to the highest in the country and dramatically increasing cigarette excises is not sound tax policy.

5 min read

When it comes to comprehensive tax reform, poorly designed local tax policies can offset any improvements brought about by state tax policies.

6 min read

Instead of adopting a highly distortive property tax assessment limit, policymakers should consider how similar goals could be met through other means.

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

As housing prices are rapidly increasing, and property tax bills along with them, the property tax has come into the spotlight in many states. The design of a state’s property tax system can affect how attractive that state is to businesses and residents.

9 min read

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

A growing number of cities, in red states like Arkansas and Texas, blue states like California and New Jersey, and purple states like Georgia and Nevada, have pursued streaming taxes in recent years.

7 min read