Hawaii‘s tax system ranks 42nd overall on the 2025 State Tax Competitiveness Index. Hawaii’s tax code is complex and includes all major tax types, placing the state among the bottom 10 on the Index. Hawaii has one of the most complex, least neutral, and progressive individual income tax systems in the nation, with 12 tax brackets, a top marginal rate of 11 percent, a very low standard deduction, and, until recently, no adjustment for inflation. It does, however, provide favorable treatment of capital gains income. Conversely, Hawaii caps small business expensing under Section 179 at $25,000, whereas most states allow $1 million.

Hawaii’s corporate income tax is also progressive (which is unusual), with a top rate of 6.4 percent. The state does not index tax brackets for inflation, does not allow full expensing, and has a throwback rule, which exposes Hawaii-based businesses to tax on certain income earned in other states.

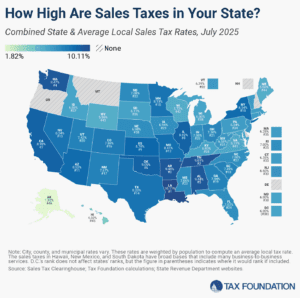

The state’s sales tax, known as the general excise tax (GET), has a relatively low rate of 4 percent but an extremely broad base that includes virtually all business inputs, both goods and services, leading to significant tax pyramiding. Hawaii also allows counties to impose local option sales taxes, generally capped at 0.5 percent.

Hawaii has the highest estate tax rate in the nation at 20 percent, with an exemption of $5.49 million. The state’s property tax system is generally competitive, and particularly features low rates on owner-occupied property, though some counties impose assessment caps on homestead properties, which are less efficient than levy limits.