Cigarette Taxes and Cigarette Smuggling by State, 2022

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

16 min readAdam Hoffer is the Director of Excise Tax Policy at the Tax Foundation. Dr. Hoffer earned his PhD in Economics from West Virginia University and his undergraduate degree from Washington & Jefferson College.

Prior to joining the Tax Foundation, Dr. Hoffer was the Menard Family Associate Professor of Economics at the University of Wisconsin-La Crosse and the inaugural Director of the Menard Family Midwest Center for Economic Engagement and Research. Dr. Hoffer was also a Bradley Freedom Fellow with the Wisconsin Institute for Law & Liberty and a senior editor with the Center for Growth and Opportunity at Utah State University.

Dr. Hoffer published 30 peer-reviewed academic journal articles and he is the lead author and editor of two books: For Your Own Good: Taxes, Paternalism, and Fiscal Discrimination in the Twenty-First Century and Regulation and Economic Opportunity: Blueprints for Reform.

He lives in La Crosse, Wisconsin with his wife and two children.

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

16 min read

With the significant potential for state revenues, and the prior political success of arguments that legalization can shift consumers to safer legal markets, it seems likely that states will continue to see legislation and ballot initiatives to legalize marijuana at the state level—even states that failed to do so this election.

5 min read

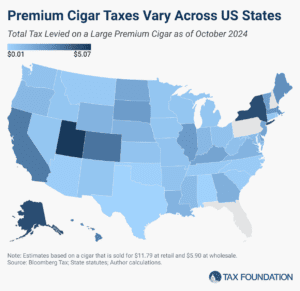

Over 500 million premium cigars were sold in the United States in 2023. With each sale comes a complex tax landscape.

4 min read

The Brazilian government is poised to make the biggest change to its alcohol tax policy in recent history.

6 min read

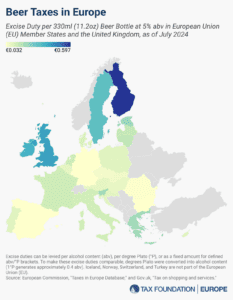

As Oktoberfest celebrations wrap up across the continent, now is a great time to examine beer taxes in the European Union. Hefty beer taxes add to the price of every drink consumed.

5 min read

Sports stadium subsidies are salient political gimmicks designed to appear as if politicians are providing tangible benefits to taxpayers. The empirical evidence shows repeatedly that stadium subsidies fail to generate new tax revenue and new jobs or attract new businesses.

6 min read

The Department of Justice (DOJ) recently announced that it would move to reschedule marijuana. This move doesn’t do as much for legal cannabis sales as proposed federal legislation like the States 2.0 Act, but rescheduling cannabis has major ramifications for cannabis businesses.

4 min read

Growing levels of waste and pollution, paired with increasing burdens on taxpayers to address environmental problems, have spurned policymakers in the US and abroad to encourage producers to be responsible, either financially or operationally, for the end-life of their products.

34 min read

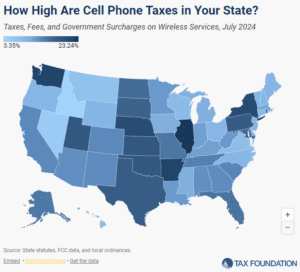

Wireless taxes and fees set a new record high in 2024.

23 min read

Legal sports betting has grown rapidly since the Supreme Court granted states the ability to establish online sports betting markets in Murphy vs. NCAA in 2018.

3 min read

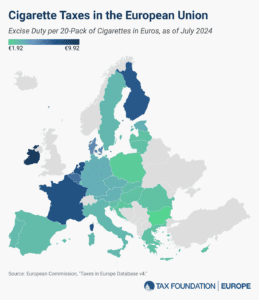

Explore the latest EU tobacco and cigarette tax rates, including EU excise duties on cigarettes. Compare cigarette taxes in Europe.

3 min read

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

By 2034, the gas tax and other car-related excise taxes are projected to raise less than half of the Highway Trust Fund’s outlays. While broader tax and spending reforms are necessary for overall deficit reduction, improving transportation funding would be a crucial step forward.

34 min read

Though gas taxes are intended to serve as user fees and pollution deterrents, they vary widely across states. How does your state’s burden compare?

4 min read

According to recent reports, 72 percent of the current marijuana market in the US is illicit. Evidently, the federal criminalization of marijuana has failed to prevent its sale or consumption.

6 min read

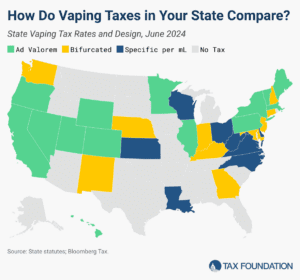

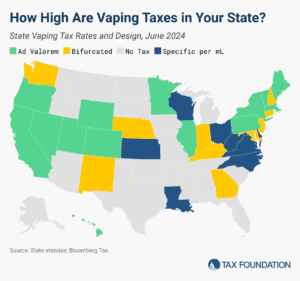

As much as 98 percent of vaping products sold in the US are illicit. Most states levy an excise tax on vaping products, but these tax systems vary substantially. The result is a messy tax system covering largely illicit products, and no one knows whether taxes are being collected and remitted on most products sold nationwide.

7 min read

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

4 min read

Different layers of taxation on production and distribution combine to make up about 40 percent of the retail price of beer.

3 min read

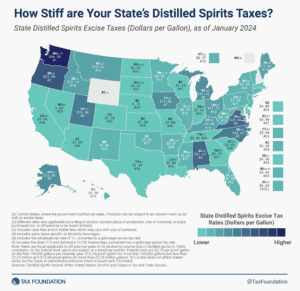

Newer products like spirits-based hard seltzers and ready-to-drink cocktails have fueled growth, while also blurring the lines of a categorical tax system. The result has been a spirited competition throughout the alcohol industry for market share, including calls to reform tax policy.

3 min read

Gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues.

8 min read